"One Good Trade" by Suri Duddella - May 18, 2023

The Magic of Fibonacci Zone Pivots and "R2 Sweep"

The Magic of Fibonacci Zone Pivots and "R2 Sweep"

The Fibonacci Zone Pivots (Floor pivot points with Fibonacci ratios), are frequently employed in technical analysis to pinpoint probable levels of support and resistance in financial markets (please read my earlier "One Good Trade" on May 8, '23). These FZP (Fib. Zone Pivots) levels are determined using the previous day's high, low, and closing prices. The psychological behavior of market participants and their propensity to respond to these support and resistance levels are the main reasons behind Fib. Zone pivots operate.

Fib. Zone Pivots are effective for a few more reasons...

Convergence of technical analysis: One of the various technical analysis methods traders utilize is Fibonacci zone pivots (FZP). When using different indicators and patterns, numerous traders and algorithms frequently congregate at the same support or resistance levels. The relevance of these levels is increased due to the convergence of the analyses, increasing their propensity to affect price changes.

Fib Zone Pivots in intraday price reference: Every day, the Fibonacci Zone Pivots are updated using the pricing information from the day before. Traders can use these levels as the trading day progresses to gauge the market mood and potential price reversals. Trading decisions can be made using this reference point's standard structure to assess the current price action.

"R2 Sweep"

On May 8, '23, an "S2 sweep" trading scenario was described. For prices to target in price rallies, "R2 Sweep" is a price Resistance level 2 in the Fibonacci Zone Pivots structure.

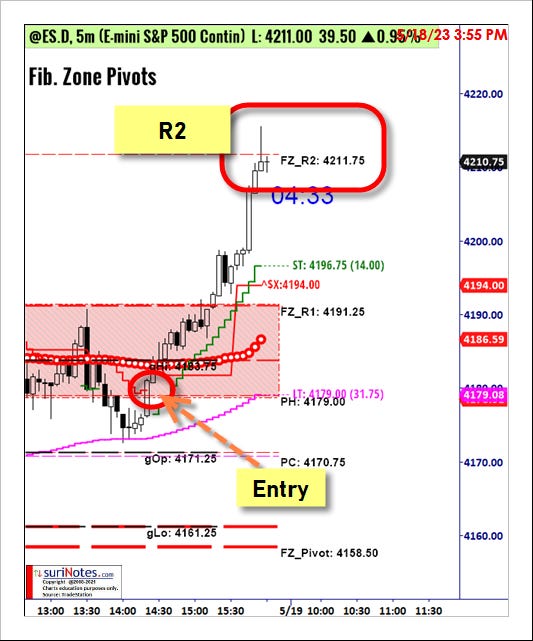

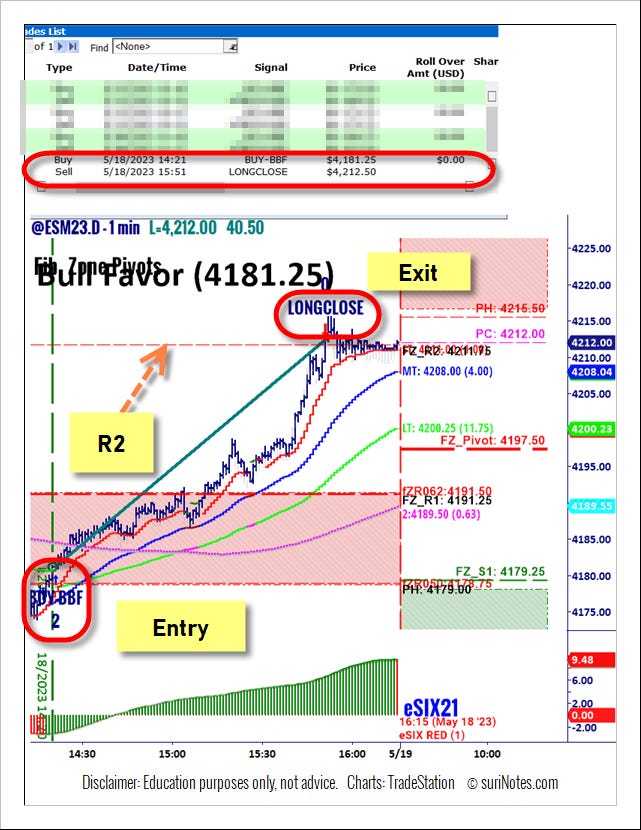

Today's S&P futures (daily) indicate a probable rally by breaking out from a significant coil (Symmetric Triangle pattern). After 2 pm, a significant intraday price increase originated from the Fib Zone Resistance zone. One of my algorithms (BBF) initiated a small long position in the FZP zone. The BBF algo. trades often have less than a 60% chance of success because of their volatility and past performance. They should not be used to trade substantial positions. The algorithm is built to add positions whenever there are sizable pullbacks.

Trade Setup

At 2:21 PM (4181.25), a small-size long trade for 2 contracts was placed in the FZP resistance 1 zone. eSIX and SuperBars trends were also positive. On a pullback to the "ST" levels, more positions were to be added in the trade. The initial stop was at the "ST" level (4178), below. An algorithm will choose whether to place its stops and objectives at significant pivot points (R2) and is designed to close the trade at the end of the day. Trading with TrailStops is advised since these transactions are susceptible to abrupt volatility fluctuations and often have win rates of less than 50- 60 percent.

ST = Short Term TrailStops

LT = Long Term TrailStop

How was it traded

At 4181.25, a long trade with two contracts was made with an initial stop below "ST" 4178. Targets were designed to exit at key pivot points. TrailStops were also used to protect trade. Another exit method is End-Of-Day. Although @ES made a few attempts, prices never provided any pullbacks to add fresh new positions. Before markets close, the trade reached the key "R2 sweep" level at 4212 and exited.

.

Trade Results/Stats

Maximum Potential Profit (2 contracts): 10+/contract

Maximum Potential Loss (2 contracts): 3-4 points/contract

Realized Profit: 31 Points/contract

Execution Efficiency: 1.0

Trade Setup Confidence: 50-60%

Tools Used

Fib. Zone Pivots

TrailStops

eSIX

Super Bars

MAs

Auto Trade Algo. BBF